Efficient accounts payable is essential for modern businesses. Manual invoice processing is costly and outdated. In 2024, studies showed that 66 per cent of teams still manually enter invoice data while only five per cent are privy to automation using AI. This leads to low visibility, increased stress and frequent payment issues. However, with the right tools, businesses can transform this into a fast, reliable and scalable process.

Companies that automate their accounts payable process reports up to 80 per cent faster approvals and 70 per cent lower processing cost. The average cost per invoice drops from $6.20 to just $1.42. These savings free up valuable time and budget, so finance teams can focus on strategic tasks. Digital workflows also reduce manual errors and help ensure every invoice is paid correctly and on time. This creates better supplier relationships and improves business cash flow.

In 2025, automation in finance is no longer a choice but a necessity. It allows companies to manage payments, track expenses and monitor cash flow in real time. AI now supports invoice scanning, data extraction and matching with purchase orders. If something seems wrong, it flags it for review. This removes the need for most manual checks and improves both accuracy and speed. While AI adoption is still growing, more companies are seeing the value of faster invoice handling and smarter decision-making.

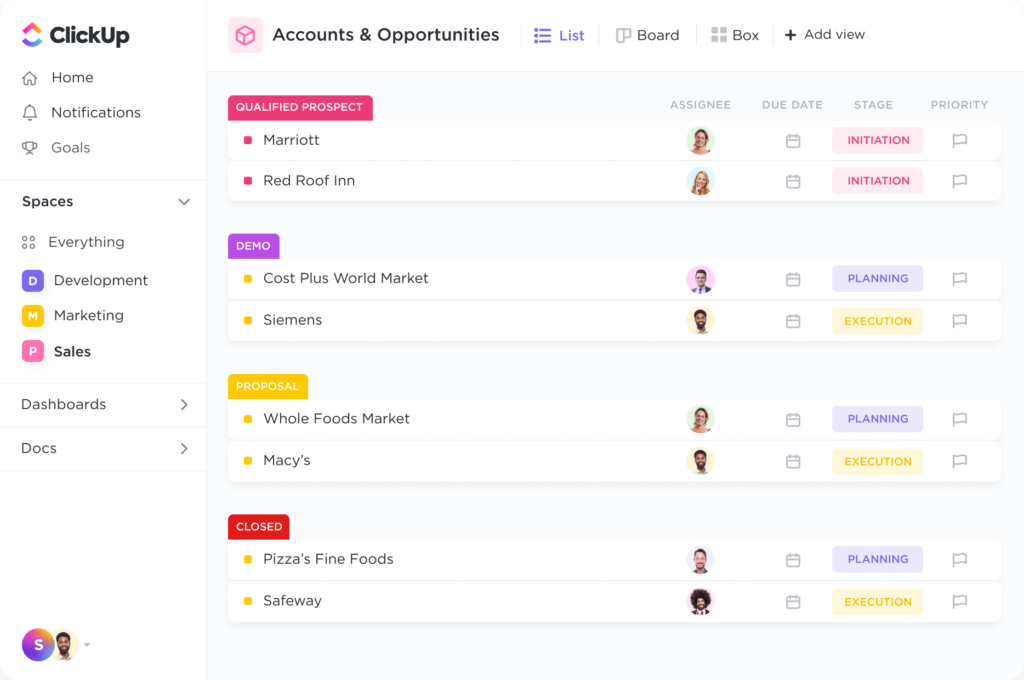

Using ClickUp for accounts payable offers a practical way to build structured workflows. Each invoice follows a clear path with status like Caption Coding, Routing, Verification and Complete. Custom fields capture key data like due date, payment amount and vendor contact. This setup ensures full visibility across the process. Everyone knows who is responsible for what and there is less risk of delays or missed steps.

With automated notifications, ClickUp alerts the team before an invoice is overdue. Vendors can even submit their details through forms that goes straight into the workflow. This reduces back-and-forth emails and prevents data entry mistakes. Finance professionals can track the status of every payment without opening multiple files or chasing team members. This boosts productivity and ensures nothing slips through the cracks.

Vendor satisfaction improves too. On-time payments are essential for keeping partnerships strong and ensuring a steady supply of goods or services. A reliable accounts payable system builds trust and reduces conflicts over late fees or lost invoices. With automation, there is always a record of when and how a payment was processed. This makes communication smoother and helps avoid disputes.

For growing companies, this setup is especially helpful. Whether they process 50 or 5000 invoices a month, ClickUp adjusts to their needs. Retailers use it to prioritise fast-moving stock suppliers. Manufacturers track multiple vendors linked to production schedules. Consultants and service firms sort invoices by client or project to simplify accounting. Thissystem works across different industries and scales easily with business growth.

It is not just about faster payments. Automation gives finance leaders better insight into operations. Dashboards show upcoming liabilities, vendor performance and spending trends. Businesses can plan more effectively and avoid cash flow problems. For example, if budgets are tight, they can delay low-priority payments or combine multiple invoices into one payment batch. This flexibility is critical during uncertain economic times.

Automation also improves compliance and security. Every transaction is recorded with a full audit trail, showing who approved it and when. This makes audits easier and supports internal policy enforcement. Teams do not need to dig through emails or paper files. Everything is digital, secure and accessible. This helps businesses meet local regulations and build trust with stakeholders.

By using ClickUp, companies avoid switching between spreadsheets, email threads and accounting systems. Everything is in one place. Teams collaborates smoothly and leaders get a full view of what is happening at all times. This unified approach is what makes tools like ClickUp so effective for managing accounts payable.

Organisations that have already embraced automation reports fewer errors, better team alignment and quicker responses to supplier’s needs. The reduction in manual work also boosts morale in finance teams and frees up time for learning new skills or supporting broader company goals. In a competitive business environment, having an efficient and transparent accounts payable system is a real advantage.

If your business is considering this shift, Affabletech can help. We support teams in setting up ClickUp for financial workflows and tailor automation tools to suit your needs. With our expert guidance, your accounts payable process can be future-ready, scalable and reliable from day one. From setup to automation and beyond, Affabletech helps businesses unlock the full value of their systems.

Let Affabletech streamline your payments and financial operations through ClickUp so you can focus on what matters the most – growth, productivity and long-term success.